Ways You Can Give

| Way to Give | What It Looks Like | Why It Matters | How to Get Started |

|---|---|---|---|

| One-Time Donation | A single gift via our website or mail. | Brings immediate help—for groceries, utility bills, or travel to medical appointments. | Donate Now |

| Monthly & Quartly Support | Regular gifts (monthly or quarterly). | Ensures ongoing relief for families with long treatment timelines. | Choose “Monthly Gift” on the donation page. |

| Gifts in Honor / Memory | Dedicate your gift in someone’s name. | Creates a tribute that gives emotional meaning while helping a household under strain. | When donating, select “In Honor / Memory” and provide details. |

| Donor Advised Funds / Legacy Gifts | Giving through a fund or via estate planning. | Amplifies long-term impact and provides flexible support where it’s most needed. | Talk with your fund manager or contact us to set it up. |

| Corporate & Matching Gifts | Companies sponsoring or matching employee gifts. | Magnifies every dollar given and spreads awareness across workplaces. | Ask your employer if they offer matching; contact us to partner. |

| Gifts-in-Kind | Non-monetary donations—items, services, or professional labor. | Fulfils critical needs and stretches every donated dollar further. | Check our “Gifts in Kind” list on what’s currently needed. |

| Stock Donation | Transfer of stock | Covers medical bills | Click DTC Transfer Form |

HOW TO SUPPORT

Give Hope. Be the Difference.

When a child is fighting for their life, every moment, every resource, every caring hand counts. Your generosity becomes more than a donation – it becomes relief, strength, and dignity for families in crisis. Here are the ways your support can change lives.

How Your Support Becomes Relief

We provide personalized, dignity-preserving assistance.

We believe in support that is direct, meaningful, and tailored. Instead of broad fundraising, your gift pays for what matters most– medical necessities, home modifications, groceries, or critical bills– so families can focus on fighting, not finances.

Gifts of Goods and Services

In addition to donations, we depend on donated gifts of goods and services to help families make ends meet so they do not go further into debt from overwhelming medical bills.

You can drop off or mail your gift to our office Monday-Friday any time between 9:00-4:00. The address is 2382 Faraday Ave, Suite 150, Carlsbad, CA 92008.

Home Supplies

🏡

⛽️

Gift Cards for gas, restaurants, food delivery...

🎡

Amusements Park Gift Certificates

🛒

Grocery Store Gift Cards

New Toys

🧸

Home Repair Certificates

🔨

How Your Gift Helps

List of Services

-

$50,000 +Item Link

ADA Conversion remodel.

-

$25,000Item Link List Item 4

Supports home repairs to make homes ADA accessible.

-

$10,000Item Link List Item 3

Supports medical expenses not covered by insurance.

-

$5,000Item Link List Item 2

Supports a family's living expense, utility bills and auto.

-

$2,500Item Link List Item 1

Air Travel to get patient to doctors and hospitals for specialized treatments and childcare for siblling support.

List of Services

-

$1,500Item Link

Kids camp for siblings and Doctor approved patients.

-

$1,000Item Link

Covers hotel and meals while away from home getting treatments.

-

$500Item Link List Item 4

Gas and food for families while away at hospitals.

-

$250Item Link List Item 3

Purchases needed medical equipment not covered by insurance.

-

$100Item Link List Item 2

Funds a child's transportation to and from the hospital for treatment.

Programs That Propel Families Forward

Support Our Programs!

There are various ways to make an impact and directly contribute to the success of our programs. If you want to get involved with a specific program, please choose the program that best supports your mission and learn how you can make an impact.

There are opportunities for customizable packages that support multiple programs, and you can email us directly at info@mitchellthorp.org to learn more.

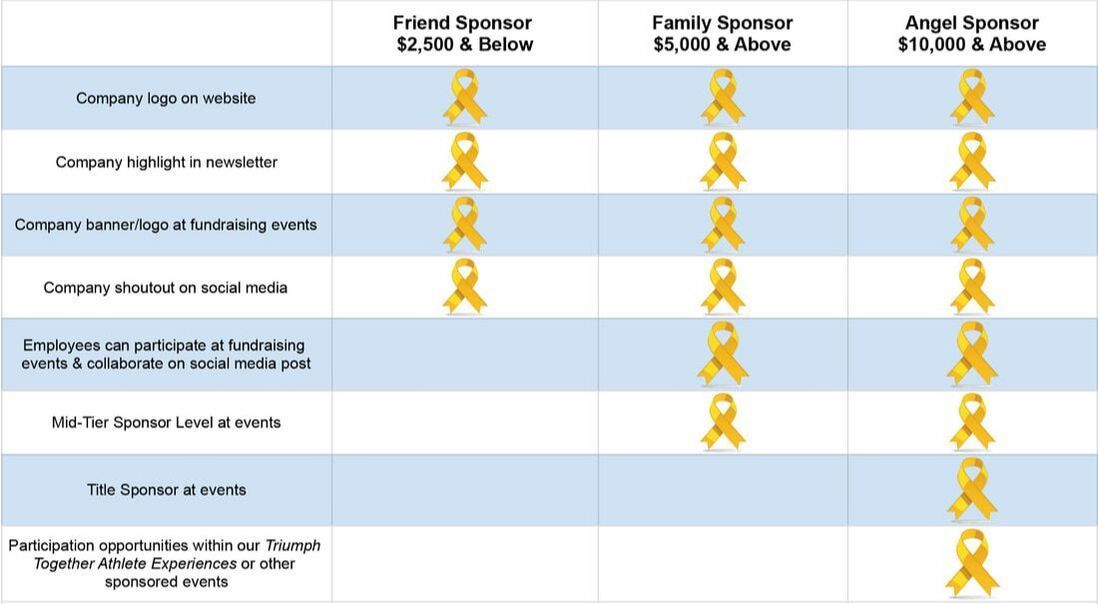

Corporate Support

Donor Advised Funds

What is a donor-advised fund?

A donor-advised fund (DAF) is a type of giving program that allows you to combine the most favorable tax benefits with the flexibility to easily support your favorite charities. An increasingly popular charitable vehicle, DAFs are an excellent way to both simplify your charitable giving and facilitate your strategic philanthropic goals.

How does it work?

- Establish your DAF by making an irrevocable, tax-deductible donation to a public charity that sponsors a DAF program.

- Advise the investment allocation of the donated assets (any investment growth is tax-free).

- Recommend grants to qualified public charities of your choice.

What are the main advantages of a donor-advised fund?

- Simplicity – The DAF sponsor handles all record-keeping, disbursements, and tax receipts.

- Flexibility – Timing of your tax deduction can be separate from your charitable decision making.

- Tax-efficiency – Contributions are tax-deductible and any investment growth in the DAF is tax-free. It is also easy to donate long term appreciated securities, eliminating capital gains taxes and allowing you to support multiple charities from one block of stock.

- Family legacy – A DAF is a powerful way to build or continue a tradition of family philanthropy.

- No start-up costs

– There is no cost to establish a donor-advised fund. However, there are often minimum initial charitable contributions to establish the DAF (typically $5,000 or more).**

- No transaction fees – Once approved, 100% of your recommended grant goes to your qualified public charity of choice.**

- Privacy if desired

– Donors may choose to remain anonymous to the grant recipient.